Fast Online Instant Approvals

500,000 Customers

No Prepayment Fees

Flexible payments

A quick & transparent process

We have

a simple online

application:

It takes just a few minutes to provide us with your information.

Using our secure application, you can e-sign your contract if pre-approved. Trust & security is our #1 priority.

Money can be directly deposited into your bank account as soon as the next business day.

Calculate Tour Rate

Things to know about our costs

Transparent and fair costs, with no hidden fees

Personal finance that fits you

We've built a secure & personalized experience

- Checking your rates won’t affect your credit score

- Our rates are often lower than the banks

- We have simple online application

- No early repayment fees, no hidden charges

Personal loans for most purposes

Building a brighter financial future

98% of our customers left satisfied

You’re in good company

Resources that put you in control

Benefits to meet your needs

Checking your rates in 3 minutes!

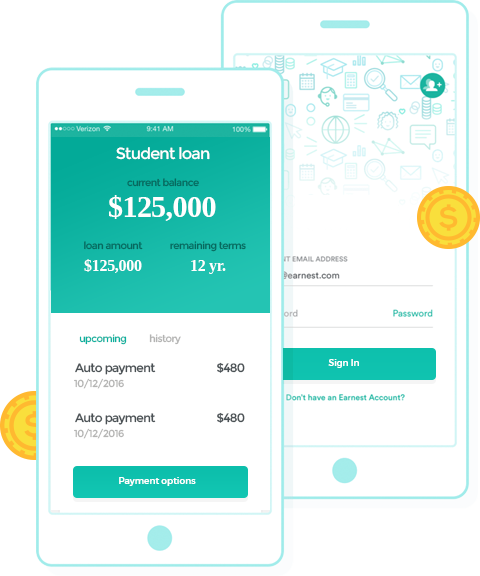

Use our app to see your personalised loan rates

Tools to help you reach your financial goals

Money education tools like YouTube financial channels and books such as Rich Dad, Poor Dad, The Richest Man in Babylon, and The Psychology of Money help you build financial knowledge. Accountability tools, including savings groups, accountability partners, and weekly financial check-ins, ensure consistency and long-term progress.

A community of over 60 million

Loans are important because they provide access to money that people or businesses may not have immediately, allowing them to meet urgent needs, invest in opportunities, or improve their quality of life. Loans help individuals pay for essential expenses such as education, medical bills, housing, or starting a business. For businesses, loans support expansion, purchasing equipment, and improving operations. Loans also help build credit history when repaid responsibly, making it easier to access future financial support. Overall, loans enable growth, solve financial challenges, and create opportunities that would otherwise be unreachable.

In-depth articles and analysis

Loans are important because they provide access to money that people or businesses may not have immediately, allowing them to meet urgent needs, invest in opportunities, or improve their quality of life. Loans help individuals pay for essential expenses such as education, medical bills, housing, or starting a business. For businesses, loans support expansion, purchasing equipment, and improving operations. Loans also help build credit history when repaid responsibly, making it easier to access future financial support. Overall, loans enable growth, solve financial challenges, and create opportunities that would otherwise be unreachable.

Ready to get started?

Need more help?

Feel free to ask us about it!

Live help

Get an answer on the spot. We’re online 8am – 7pm Mon to Fri and 9am – 3pm on Sat and Sun.

See our FAQs

See answers to questions on how to use our services